Christopher C. Woolery

Pettis County Assessor

415 S Ohio Ste 218

Sedalia, MO 65301

wooleryc@pettiscomo.com

660-826-5000 ext 920

660-829-2492 fax

Assessment Overview

The assessor is the county official charged with determining the market value and classification of property for tax purposes. This includes real estate and tangible personal property. The assessor is governed by state statutes and is overseen by the State Tax Commission.

The Assessment Process

Assessment is the process of placing a value on property for the purpose of taxation. Property tax in Missouri is “ad valorem,” meaning that taxes are based on property value. The assessor is charged with placing fair market value on property as of the tax date. This ensures the tax burden is distributed fairly among those responsible for payment.

The assessor’s work is subject to review by the County Board of Equalization and the Missouri State Tax Commission. The State Tax Commission is the state agency charged with the supervision of assessors and the enforcement of property tax laws.

The assessor has no jurisdiction for establishing the tax rates or for taxing jurisdiction budgets. The taxing authorities (schools, cities, fire districts, etc.) establish their own tax rates. The collection authority (Collector’s Office) is responsible for collecting the amount of tax assigned to each property owner.

Useful links:

Personal Property Assessment

• Assessment is the process of assigning value to property for the purpose of property taxation. In the case of personal property most people think of this in terms of automobiles and other licensed vehicles. However, personal property is more than cars and trucks. Personal property also includes things like livestock, income furniture, grain crop, farm machinery, business equipment, manufactured homes, and planes, to list a few.

• The assessed value of personal property depends on the type of and use of the property and is arrived at by applying the correct assessment percentage to the value of the property. For instance a vehicle with historic plates would be assessed at 5% of its value. Farm equipment and livestock would be assessed at 12%. Other property like cars, trucks, trailers, recreational vehicles and equipment, heavy equipment and business equipment, just to mention a few, would be assessed at 33-1/3%.

• As defined by the State Tax Commission, personal property includes every tangible thing being owned or part owned other than money, household goods, wearing apparel, and articles of personal use and adornment. Vehicle values are determined predominantly from the National Automobile Dealer’s Association (N.A.D.A.) vehicle value guides per state statute. Business equipment is generally valued based on cost/depreciation tables as applied to acquisition cost(s) of equipment, supplemented with market data where available.

• In Missouri, it is the taxpayer’s responsibility to file their personal property declaration in the county where they lived on January 1 and to list what they owned as of January 1. In January, the assessor mails assessment forms to those who are on the rolls at that time. It is the responsibility of people moving into the county who have eligible personal property to notify the assessor’s office they are here so they can be added to the assessment rolls for the year they first live here January 1. It is important to have filed a form by March 1, since penalties for late assessment may be applied to the account.

New Residents and Personal Property

• New residents to the State of Missouri must bring in their registration paper(s) or title(s) and establish an account with the Assessor’s office for the upcoming tax year. New residents are exempted from personal property taxes for the first year they were not residents of Missouri January 1. The Assessor’s office issues statements of no personal property tax due (waivers) to those individuals who qualify for them.

Missouri Residents and Personal Property

• To license your vehicles with new tags you need proof that you paid personal property taxes for the prior year. This is done with either a paid tax receipt or a waiver (certificate of no tax due or a statement of non-assessment) stating the exemption.

• The paid tax receipt indicates that you were assessed (RSMo137.075 and 137.080) in the County that you resided in January 1 of that year and that you paid on the vehicles that you owned January 1 of that year. Each county’s receipts are valid at any licensing bureau or DMV agency throughout Missouri.

• Every individual owning a vehicle on January 1 with Missouri license plates should see to it that they get assessed in their county (RSMo137.090 and 137.280) during January or February of each year.

• Most personal property is taxed in the county where the taxpayer lives. There are a few exceptions. Corporate property, houseboats, cabin cruisers, floating boat docks, and manufactured homes are assessed where they are located on January 1. Personal property of Missouri residents located outside the state is not assessed in the state. Personal property owned by non-residents of the state is taxed in the Missouri county where it is located on January 1.

• If you have moved here from another county in the State of Missouri, you will need to obtain proper tax papers from THAT county for those years that you lived there January 1.

Military and Personal Property

• Military personnel are provided Missouri personal property tax exemption papers ONLY if (1) they were in the military January 1 of the tax year in question, (2) claimed a state other than Missouri as their home of record (verified by seeing their Leave & Earnings Statement for the month of January), and (3) have Missouri license plates on their vehicles. We do this on the basis that by Federal law they are to pay personal property taxes to the state/county from which they entered the military.

• Otherwise for a Missouri resident who is active duty (even if out of state or out of country) and resided in Pettis County when they entered the military, then in accordance with the Soldiers and Sailors Relief Act, they are to be assessed for personal property taxes in Missouri county of residence (Pettis County) regardless of where they have titled and licensed their vehicles. Other states where they are stationed are supposed to be waiving personal property taxes on those vehicles.

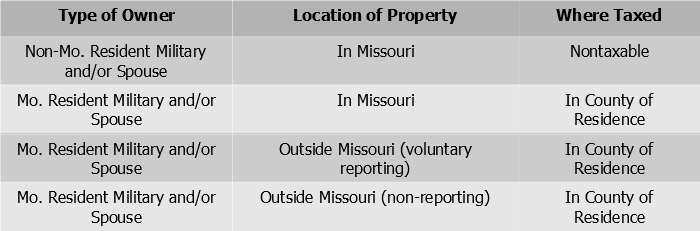

Where Military Personal Property is Taxed

The assessment of military personnel continues to be an area of confusion, judging from the number of calls we receive on this subject. The law in this area is controlled by the federal Soldiers and Sailors Relief Act of 1940 and the Military Spouses Residency Relief Act. The United States Supreme Court has stated that military personnel shall not lose their residence or domicile in their home state solely because they are absent from the state in compliance with military or naval orders. However, military personnel (and/or their spouses) stationed away from Missouri still must pay personal property taxes in Missouri assuming they retain Missouri as their State Home of Record (HOR) or have Missouri as their State of Legal Residence (SLR).

The military personnel (and/or their spouses) are treated as though they never left their home state and county. Consequently, assessors should treat the tangible personal property of Missouri personnel (and/or their spouses) stationed in other states or countries the same as if the taxpayer is living in the county and the personal property is present in the state. The other side of the matter, is that the personal property of any [non-resident] individuals residing in your county by means of military orders are not taxable in your jurisdiction, with the exception of business personal property located in Missouri and owned by non-resident military personnel.

The Attorney General issued an opinion [Burrell, Op. Att’y Gen. No 95 (Feb 16, 1966)] concluding that non-resident military personnel stationed in Missouri may obtain a certificate of no tax due (a waiver) from the collector and license their cars in Missouri without paying property tax on them.

If the vehicle is registered jointly with a non-resident military person and their military spouse, or the non-resident military spouse is the sole owner, the vehicle may not be taxed in Missouri.

Real Estate Overview

Missouri State law requires that real estate be reassessed every two years in the odd numbered year. With the exception of new construction or demolition, assessments on real property are based on a date of January 1st of the odd year. During the even numbered years, the only thing that can cause a change in the assessed valuation of real property is new construction or demolition.

How is Real Estate Reassessed?

A number of methods are used. The assessor’s staff looks at any demolition or new construction that has taken place, sales prices of comparable properties, condition of the property, its physical attributes, and any other factors that can help place an accurate value on the property. The goal is to establish fair market value. Fair market value is the price the property would bring when offered for sale by a person who is willing but not obligated to sell it, and is bought by a person who is willing to purchase it but who is not forced to do so. This value is at rates based on use. Those rates are Residential 19%, Agricultural 12%, and Commercial 32%.

Appealing Your Property Value

The assessor is required by state statute to notify the owner of record of an increase in the valuation of real property. If you do not agree with your assessment, there is an appeal process. There are three steps to the process:

1. Informal Appeals – You should contact the county assessor’s office as soon as you are notified of your assessment. An informal meeting should be scheduled with the assessor or one of the staff where you can ask how your assessment was made, what factors were considered, and what type of records pertain to your property. Many disagreements are resolved at this level.

2. Board of Equalization – If you not satisfied after the informal meeting, you should contact your county clerk for information regarding forms and deadlines for appealing to the county Board of Equalization. A hearing will be scheduled where the board will hear evidence from the assessor and any evidence you might have regarding the value of the property, which is the subject of the appeal.

3. State Tax Commission – If you are still not satisfied with the assessment on your property, you have a right to appeal to the State Tax Commission by September 30 or 30 days after the final action of the Board of Equalization, whichever date is later.

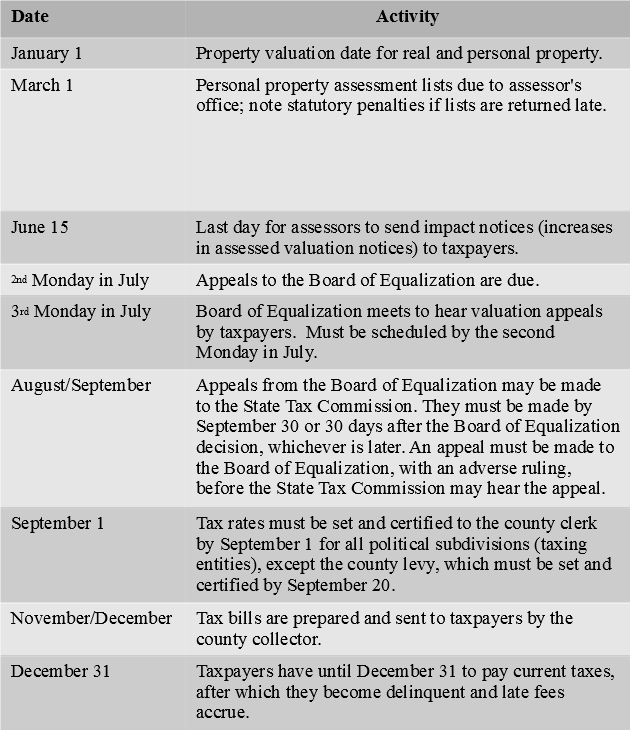

Assessment Calendar